If you're planning to buy a home, the first step is figuring out how much money you need to save. There will be closing costs, closing fees, and moving expenses. You also have to consider ongoing maintenance and repairs. To help you understand how much money is needed to buy a home, we have created this handy calculator. It will show you how much money it takes to make a down payment, pay your mortgage, or cover ongoing maintenance and repairs.

How Much Can I Afford?

The amount you can afford to spend on a house depends on several factors, including your income and your debt load. In order to qualify for a loan mortgage, your housing costs must not exceed 28%.

A down payment? Save your money

In most cases, you'll need at least a 5-10% down payment on a home to avoid paying private mortgage insurance (PMI), which is often a requirement of many loans. The amount of down you will need depends on how good your credit is and what type of loan you have.

How to Save Money for a Down Payment

The best way to start saving for a down payment is to create a budget. This will show you what you can afford to spend each month and where you might be able to trim costs. Now it's time for you to start saving.

These are just a few steps that will help you quickly reach your savings goals. You should first get rid of all your debt. Then, start building an emergency fund with 3-6 months worth of living expenses. This will help you avoid unexpected costs.

You can make small withdrawals from your paycheck or set up automatic deposits to a savings account when you are ready to save. Once you have accumulated a significant amount of savings, you are ready to start looking for a house.

How to Use Your Down Payment funds

Most lenders require that your down payment be sourced from your own financial resources. This can include funds you've accumulated from saving, selling an asset or earning a raise at work. If you don’t have enough money, you can either choose a lower-priced home or put off buying your house until you save more.

How to Find a Less Expensive Mortgage

By comparing mortgage rates, you can cut down on your home-buying cost. Some lenders offer a variety of options, including fixed-rate and adjustable-rate mortgages. Some lenders allow you to borrow part of the purchase amount as a downpayment.

Conventional, FHA, VA loans are some of the most common types for home buyers. Each loan has its benefits and requirements, but they all have one thing in common: It can be difficult to get a loan without large down payments.

It is possible for you to buy a house using a very small down payment. However it will take patience and you need to save more. Start by cutting down on your expenses and gradually increasing your down payment.

FAQ

What amount of money can I get for my house?

This can vary greatly depending on many factors like the condition of your house and how long it's been on the market. The average selling price for a home in the US is $203,000, according to Zillow.com. This

How many times may I refinance my home mortgage?

This is dependent on whether the mortgage broker or another lender you use to refinance. You can typically refinance once every five year in either case.

How can I determine if my home is worth it?

You may have an asking price too low because your home was not priced correctly. Your asking price should be well below the market value to ensure that there is enough interest in your property. Our free Home Value Report will provide you with information about current market conditions.

Should I use a broker to help me with my mortgage?

If you are looking for a competitive rate, consider using a mortgage broker. Brokers can negotiate deals for you with multiple lenders. Brokers may receive commissions from lenders. You should check out all the fees associated with a particular broker before signing up.

Is it possible to quickly sell a house?

It might be possible to sell your house quickly, if your goal is to move out within the next few month. But there are some important things you need to know before selling your house. You must first find a buyer to negotiate a contract. Second, you need to prepare your house for sale. Third, your property must be advertised. Finally, you should accept any offers made to your property.

How long does it take to sell my home?

It depends on many factors, such as the state of your home, how many similar homes are being sold, how much demand there is for your particular area, local housing market conditions and more. It may take up to 7 days, 90 days or more depending upon these factors.

Statistics

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

External Links

How To

How to Find a Real Estate Agent

A vital part of the real estate industry is played by real estate agents. They are responsible for selling homes and property, providing property management services and legal advice. Experience in the field, knowledge about your area and great communication skills are all necessary for a top-rated real estate agent. You can look online for reviews and ask your friends and family to recommend qualified professionals. Consider hiring a local agent who is experienced in your area.

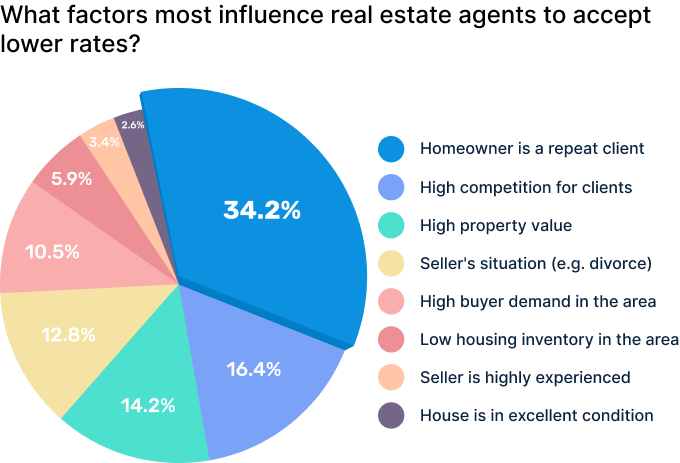

Realtors work with both buyers and sellers of residential real estate. A realtor helps clients to buy or sell their homes. In addition to helping clients find the perfect house, realtors also assist with negotiating contracts, managing inspections, and coordinating closing costs. Most realtors charge a commission fee based on the sale price of the property. Unless the transaction closes however, there are some realtors who don't charge a commission fee.

There are many types of realtors offered by the National Association of REALTORS (r) (NAR). NAR requires licensed realtors to pass a test. The course must be passed and the exam must be passed by certified realtors. NAR designates accredited realtors as professionals who meet specific standards.