It is important to learn about the company before buying a REIT. You should learn about the company's past and how it compares with other companies. This way, you will be able to determine whether or not it will pay dividends well. Be aware of the risks involved in buying REITs.

Tip: Purchase REITs

You should consider the quality of REITs and the earnings before investing. The company's earnings are made up of any dividends and funds from its properties. Also, you should consider the investment fees. Diversification by REITs is another important factor. Some REITs have a high level of investment in certain types of properties, which can increase the chance of a loss. You should diversify your portfolio to reduce your risk.

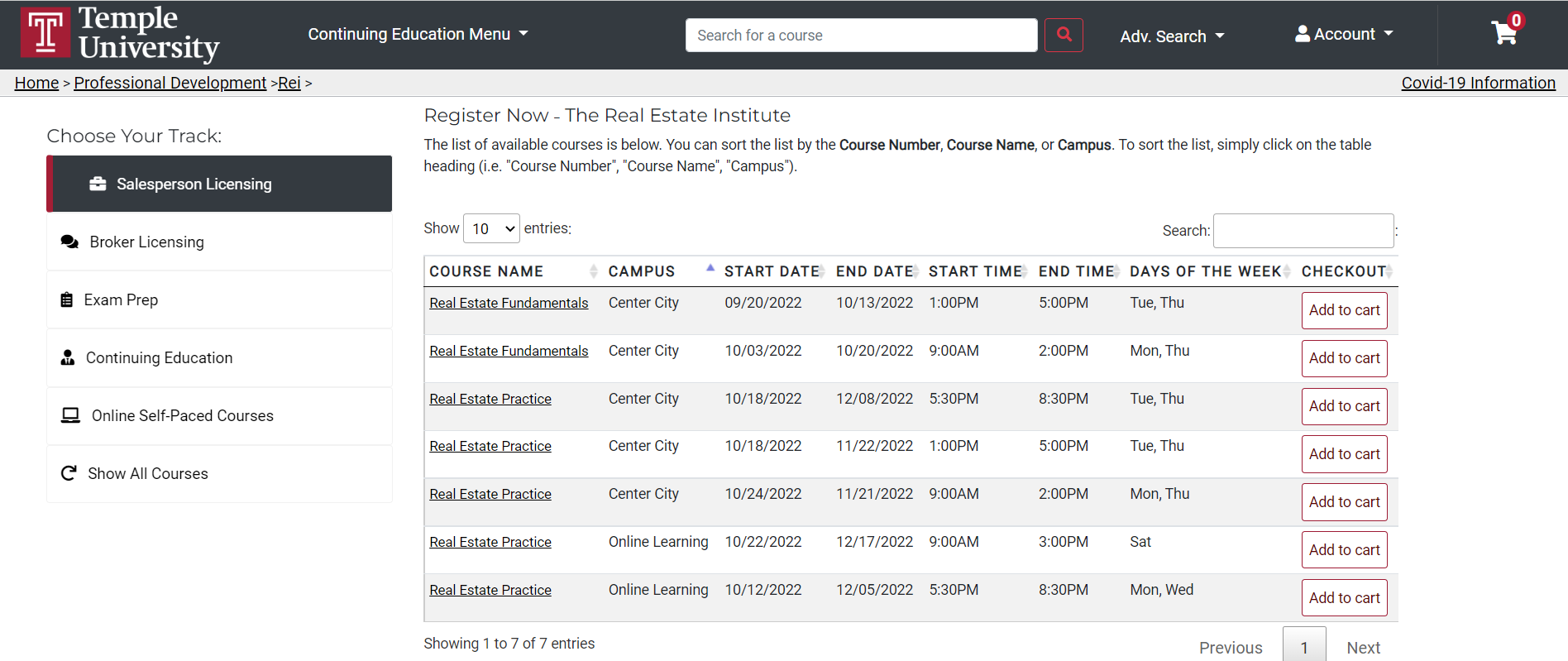

One of the best ways to invest in REITs is to set up a brokerage account. It takes only a few minutes to set up a brokerage account that allows you buy and sell publicly traded REITs. Many of these investments pay high dividends. Some REITs offer the possibility of holding your funds in a tax preferred account. This allows you to avoid paying taxes on distributions.

Dividends subject to taxes

Investors should be aware that dividends are subject to taxes when purchasing REITs. Capital gains are when a REIT sells real estate assets. These capital gains can be included in dividends. The amount you pay in tax will depend on whether you qualify for tax concessions. If he or she doesn't qualify for special tax concessions, the dividend will be taxed at the investor's marginal tax rate.

Investors can avoid taxes by buying REITs that do not require close ownership. It is important to avoid REITs with less than a five-year record of paying dividends. REITs can't be owned by more than half of the population. Fortunately, the new tax law, the Tax Cuts and Jobs Act, provides a 20% deduction for pass-through income.

Liquidity

Reits should be aware of the importance of liquidity. It can help them withstand unexpected changes in the value of the assets. REITs may also be able to increase their worth by distributing some of their earnings towards their investors. REITs took advantage of lower interest rates during the recent downturn to improve liquidity and increase their cash balances. But REITs should not considered safe investments. Volatility is a natural part of business.

REITs can also provide liquidity as shares are available for purchase and sale on the stock market. Investors have access to liquidity that can be used to access cash and change their investment strategies. In addition, investors may find REITs attractive because real estate is a non-correlated asset class.

There are risks associated with investing in REITs

While REITs can provide a steady income in the form of dividends, investors should also keep in mind that REITs are not risk-free investments. This is because REITs are traded just like stocks and can go down in value. REIT stocks can be risky investments. However, they have to compete with other high yield investment options.

The risk of interest rate rises is another. Rising interest rates could lead to increased borrowing costs for REITs. This will impact their cash flows. However, these risks can be mitigated by the fact that REITs tend to have solid balance sheets. This is because the managers of these companies strive to maintain a healthy level in leverage. Investors should pay attention to this aspect.

When to Buy

Before you decide to invest in REITs, it's important to consider your financial situation and investment goals. You should also understand the tax implications of REITs. Investors who seek to maximize their tax savings may not choose REITs because they are a great choice since they generate large amounts of their value from dividend income.

Uncertainty around the expiration date for master leases is a big problem for REITs. This uncertainty is often driving investors to sell. Their fundamentals have been affected as a consequence. Despite the uncertainty many investors fail to realize the fact short-term issues don't have much impact on the long-term prospects.

FAQ

What should I look for in a mortgage broker?

A mortgage broker is someone who helps people who are not eligible for traditional loans. They work with a variety of lenders to find the best deal. Some brokers charge fees for this service. Others offer no cost services.

Do I need flood insurance

Flood Insurance covers flooding-related damages. Flood insurance protects your belongings and helps you to pay your mortgage. Learn more about flood coverage here.

How can I get rid of termites & other pests?

Termites and other pests will eat away at your home over time. They can cause serious destruction to wooden structures like decks and furniture. This can be prevented by having a professional pest controller inspect your home.

What should you think about when investing in real property?

You must first ensure you have enough funds to invest in property. If you don’t have the money to invest in real estate, you can borrow money from a bank. Also, you need to make sure you don't get into debt. If you default on the loan, you won't be able to repay it.

You must also be clear about how much you have to spend on your investment property each monthly. This amount should include mortgage payments, taxes, insurance and maintenance costs.

It is important to ensure safety in the area you are looking at purchasing an investment property. It would be best to look at properties while you are away.

Statistics

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

External Links

How To

How to purchase a mobile home

Mobile homes are houses built on wheels and towed behind one or more vehicles. Mobile homes were popularized by soldiers who had lost the home they loved during World War II. Mobile homes are still popular among those who wish to live in a rural area. Mobile homes come in many styles and sizes. Some houses have small footprints, while others can house multiple families. There are some even made just for pets.

There are two main types for mobile homes. The first type is produced in factories and assembled by workers piece by piece. This occurs before delivery to customers. A second option is to build your own mobile house. It is up to you to decide the size and whether or not it will have electricity, plumbing, or a stove. Next, make sure you have all the necessary materials to build your home. To build your new home, you will need permits.

If you plan to purchase a mobile home, there are three things you should keep in mind. You might want to consider a larger floor area if you don't have access to a garage. Second, if you're planning to move into your house immediately, you might want to consider a model with a larger living area. Third, make sure to inspect the trailer. Damaged frames can cause problems in the future.

You need to determine your financial capabilities before purchasing a mobile residence. It is important to compare prices across different models and manufacturers. It is important to inspect the condition of trailers. There are many financing options available from dealerships, but interest rates can vary depending on who you ask.

Instead of purchasing a mobile home, you can rent one. Renting allows you the opportunity to test drive a model before making a purchase. Renting isn’t cheap. The average renter pays around $300 per monthly.