If you have a 100k investment and are looking for an option that provides a passive income and predictable returns, consider real estate investment. You can build huge equity quickly and with minimal work by investing in real estate. You can invest in a million dollar house with a down payment of only 100k, and build huge equity over time.

Real estate is the best way to invest.

Real estate investment is the best choice if you have more than 100 thousand dollars. Not only does real estate earn a substantial cash flow each year, but it can also provide a solid personal asset for future generations. Real estate is an excellent option if you are looking to diversify your portfolio.

IRAs can be used as a passive investment.

An IRA is a great option for 100k investment and offers tax benefits. The IRA allows you to have more control than a 401k plan and can be used for stocks, ETFs or other asset classes. The right investment strategy can help you grow your investments over the long-term while also taking advantage of tax incentives.

Mutual funds

A $100k investment requires you to be cautious about the type of funds that you choose. Stock investing can be very risky, especially if it's not done properly. Bonds, on the other hand, are less risky. These bonds have lower returns but you will earn less. Your age and general health are important factors to consider. Also, think about how long you can afford to keep your money in one place for five to ten years.

ETFs

Consider switching to mutual funds, or exchange-traded securities, if you plan to invest more than 100 000 dollars. These passive investments have low fees and can be set up to automatically invest recurring amounts over time. ETFs offer many advantages over individual stocks, and the barriers to entry are relatively low.

SIPPs DIY

If you're considering a DIY SIPP for your first 100k investment, there are a few factors to consider before you invest. You will first need to choose an investing platform. You should also decide how much you want to invest. You can check out their SIPP if you want to invest in Vanguard funds. Otherwise, you might want to look into other SIPP providers, such as Hargreaves Lansdown or Fidelity.

You get tax benefits by investing in a qualified 401(k).

A 401(k), or IRA, can provide many tax benefits. First, it is tax-deferred. This means that your money grows tax-deferred up until the time you retire. This tax deferral benefit can be applied to traditional and Roth Roth 401 (k) accounts.

FAQ

What should I look for when choosing a mortgage broker

A mortgage broker helps people who don't qualify for traditional mortgages. They work with a variety of lenders to find the best deal. Some brokers charge a fee for this service. Others offer free services.

How do I eliminate termites and other pests?

Over time, termites and other pests can take over your home. They can cause severe damage to wooden structures, such as decks and furniture. A professional pest control company should be hired to inspect your house regularly to prevent this.

Can I get a second loan?

Yes. But it's wise to talk to a professional before making a decision about whether or not you want one. A second mortgage is often used to consolidate existing loans or to finance home improvement projects.

Statistics

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

External Links

How To

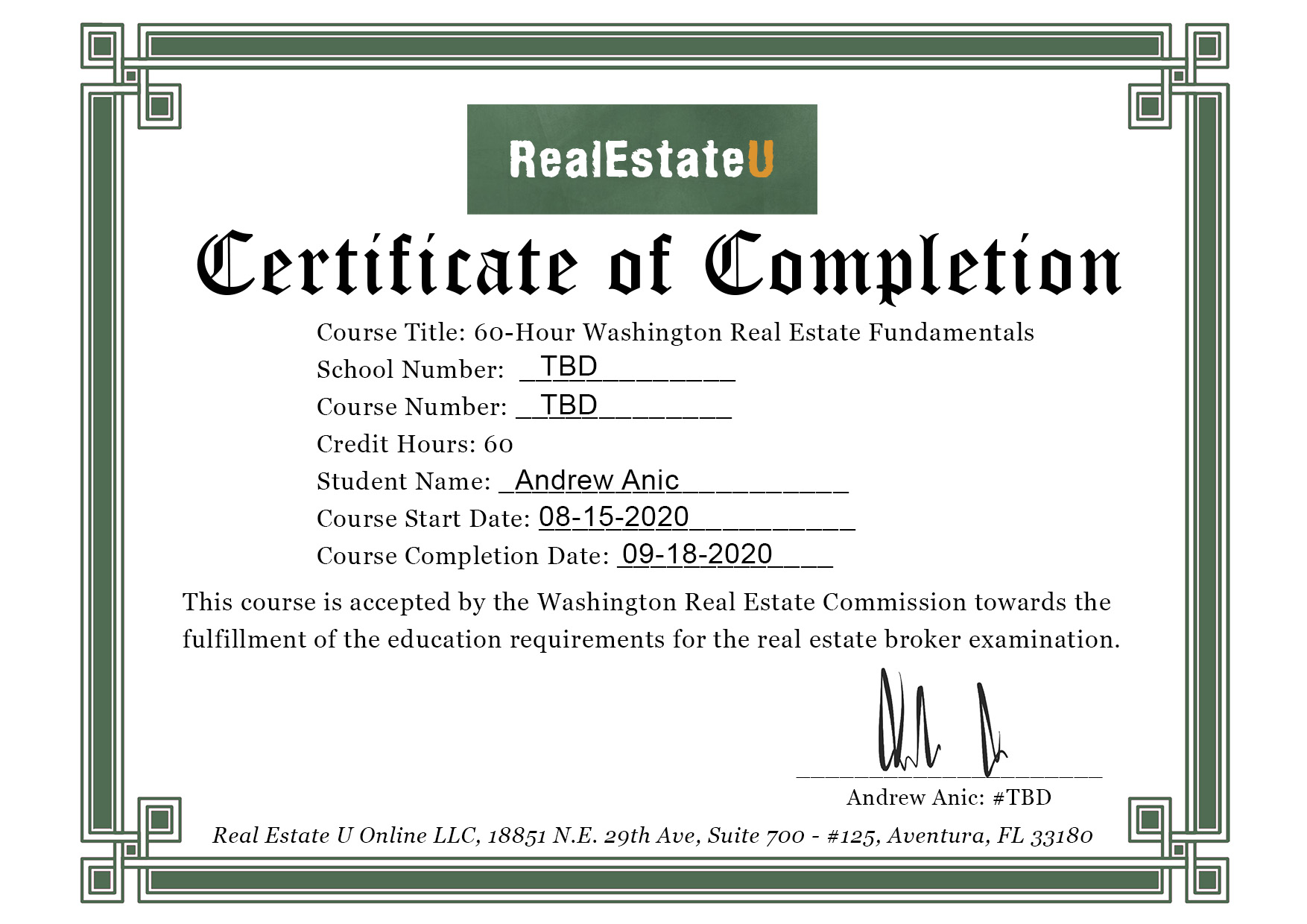

How to become an agent in real estate

You must first take an introductory course to become a licensed real estate agent.

The next step is to pass a qualifying examination that tests your knowledge. This involves studying for at least 2 hours per day over a period of 3 months.

Once you have passed the initial exam, you will be ready for the final. For you to be eligible as a real-estate agent, you need to score at least 80 percent.

You are now eligible to work as a real-estate agent if you have passed all of these exams!