If you are interested in becoming a real estate agent, you will need to get a Kentucky real estate license. The process is straightforward and easy. But there are some important requirements that you need to meet. To begin, you must pass a background screening and get Errors And Omissions insurance.

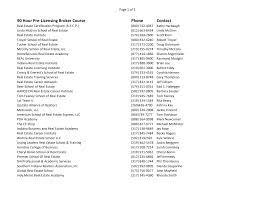

Pre-licensing education is required before you can start your real estate career. This course includes background checks, fingerprinting, as well as a pre-licensing examination. Accreditation of a real-estate school is essential. The school can determine the cost of your coursework. It can cost from $300 up to $500. You can also use academic credit from accredited colleges to reduce the number of hours required.

After you have completed pre-licensure education you are eligible for the real exam. The Kentucky Real Estate Commission (KREC) will review your application and determine whether or not you qualify to sit for the exam. You will need two identifications to take the test. One of them must be government-issued and the other must show your legal name and signature.

After you submit an application, you'll receive an email from Kentucky Real Estate Commission. Make sure you carefully read the email.

KREC will issue you a score report with a list containing items required. This report will be sent to you within 36 to 48 hours.

After you have been awarded your passing score, it is time to apply for a license as a real estate agent. The license allows the you to rent and sell real property in Kentucky. The renewal of your license is required. In addition, continuing education classes are required. These courses are called Core Courses, and you must complete at least six credits annually. During the first few years of your career, it is important to find an experienced trainer. Good trainers will help you to follow a repeatable and systematic process.

After you have successfully completed your training, the real estate licensing exam will be required. Kentucky's exam is a 240 minute long with 130 questions. Candidates should plan to spend at most three to four month completing their training as well as the exams.

To obtain an E&O (estate-issued) insurance policy, you will need to have a real estate licence. Private insurance companies offer E&O coverage. Additionally, you can join a group E&O policy.

The exam must be taken at a PSI testing centre. The exam can be taken online. For the application and exam, you will generally need to pay $130. Your application will be processed once you have submitted all of your required documentation.

The Kentucky Real Estate Commission will review each application on a individual basis. If you fail to fulfill any component, you will need to retake the entire exam. If you fail to meet any of the required components, you will be charged $100.

FAQ

What should I be looking for in a mortgage agent?

People who aren't eligible for traditional mortgages can be helped by a mortgage broker. They search through lenders to find the right deal for their clients. Some brokers charge a fee for this service. Others offer free services.

How much will my home cost?

It all depends on several factors, including the condition of your home as well as how long it has been listed on the market. Zillow.com shows that the average home sells for $203,000 in the US. This

How do you calculate your interest rate?

Market conditions impact the rates of interest. The average interest rates for the last week were 4.39%. Add the number of years that you plan to finance to get your interest rates. Example: You finance $200,000 in 20 years, at 5% per month, and your interest rate is 0.05 x 20.1%. This equals ten bases points.

Should I buy or rent a condo in the city?

Renting might be an option if your condo is only for a brief period. Renting allows you to avoid paying maintenance fees and other monthly charges. The condo you buy gives you the right to use the unit. You have the freedom to use the space however you like.

What is a "reverse mortgage"?

A reverse mortgage lets you borrow money directly from your home. This reverse mortgage allows you to take out funds from your home's equity and still live there. There are two types: government-insured and conventional. You must repay the amount borrowed and pay an origination fee for a conventional reverse loan. FHA insurance covers the repayment.

Statistics

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

External Links

How To

How to find real estate agents

The real estate market is dominated by agents. They can sell properties and homes as well as provide property management and legal advice. The best real estate agent will have experience in the field, knowledge of your area, and good communication skills. You can look online for reviews and ask your friends and family to recommend qualified professionals. You may also want to consider hiring a local realtor who specializes in your specific needs.

Realtors work with both buyers and sellers of residential real estate. It is the job of a realtor to help clients sell or buy their home. As well as helping clients find the perfect home, realtors can also negotiate contracts, manage inspections and coordinate closing costs. Most realtors charge a commission fee based on the sale price of the property. Unless the transaction closes however, there are some realtors who don't charge a commission fee.

The National Association of REALTORS(r) (NAR) offers several different types of realtors. NAR membership is open to licensed realtors who pass a written test and pay fees. The course must be passed and the exam must be passed by certified realtors. NAR designates accredited realtors as professionals who meet specific standards.